Ethereum Price Prediction: Institutional Momentum vs Technical Resistance

#ETH

- Technical Positioning: ETH trades below key moving averages but above crucial Bollinger support at $4,068

- Institutional Momentum: Major holders expanding positions and supply constraints support medium-term bullish thesis

- Risk-Reward Profile: Current levels offer favorable entry for long-term investors with proper risk management

ETH Price Prediction

Technical Analysis: ETH Shows Mixed Signals Near Key Support

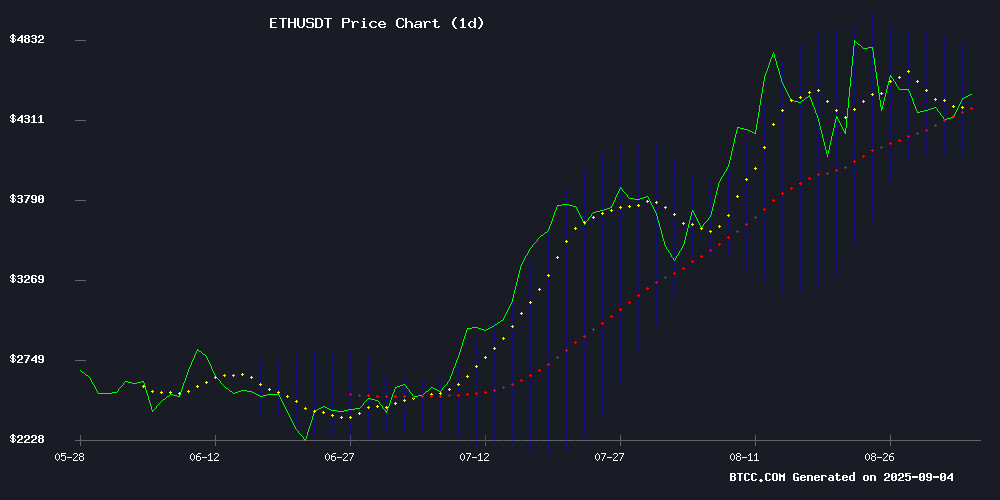

ETH is currently trading at $4,323, below its 20-day moving average of $4,438.54, indicating short-term bearish pressure. The MACD reading of -51.60 suggests ongoing downward momentum, though the positive histogram value of 28.95 shows some buying interest emerging. Price is trading within the Bollinger Bands with support at $4,068 and resistance at $4,808.

According to BTCC financial analyst Michael, 'ETH is testing crucial support levels. A break below $4,068 could trigger further declines, while holding above this level may set the stage for a rebound toward the middle band around $4,438.'

Institutional Demand Fuels Optimistic ETH Outlook

Recent news highlights strong institutional interest in Ethereum, with several major holders expanding their positions. Headlines suggest price targets ranging from $5,500 to $8,000, driven by supply constraints and whale accumulation. However, some reports note a 4% pullback after testing resistance levels, indicating potential volatility ahead.

BTCC financial analyst Michael comments, 'The institutional narrative remains strongly bullish, but technical resistance around $4,800 needs to be cleared for the $5,500-$6,000 targets to become achievable. Supply dynamics and whale activity provide fundamental support for medium-term appreciation.'

Factors Influencing ETH's Price

Ethereum Targets $6K–$8K as Institutional Demand Fuels Breakout

Ethereum's price hovers near $4,400, with analysts eyeing a decisive breakout above the $4,450–$4,500 resistance zone. A successful push could propel ETH toward $6,000, with bullish forecasts extending to $8,000. Institutional inflows totaling $1.2 billion and renewed ETF interest are driving optimism.

Technical indicators highlight $4,500 as a critical level, aligned with the 0.5 Fibonacci retracement. A close above this threshold may trigger rallies to $4,729 and beyond, while failure to hold risks a retest of near-term support. ETH remains 11% below its August peak of $4,950, but whale activity and advocacy-driven funding suggest latent upward momentum.

Ethereum Price Dips 4% After Testing Key Resistance Amid Institutional Support

Ethereum's price volatility intensified as it retreated 4% after briefly testing the $4,400 resistance level. Despite the pullback, institutional demand remains a bullish counterweight—highlighted by The Ether Machine's 150,000 ETH purchase, bringing its total holdings to nearly $2.2 billion.

ETF inflows underscore Ethereum's institutional appeal, with CoinShares reporting $37.9 billion in assets under management. "Smart money is treating ETH as a strategic asset, not a trade," noted market analyst Simon Chandler, pointing to sustained accumulation by professional investors.

The Ethereum Foundation's planned sale of 10,000 ETH ($43 million) for ecosystem funding introduced mild bearish pressure. Market participants now watch whether institutional buying can outweigh profit-taking to reignite upward momentum.

Hackers Exploit Ethereum Smart Contracts to Distribute Malware in Sophisticated Campaign

Malicious actors are poisoning public code libraries with malware delivered via Ethereum smart contracts, according to a report by software security firm ReversingLabs. Two Node Package Manager (NPM) libraries, colortoolsv2 and mimelib2, were found to contain scripts that download malware through smart contracts—a novel approach in cyberattacks.

Binance Chief Security Officer Jimmy Su previously linked similar package poisoning tactics to North Korean hackers. The campaign uses fake activity to lend legitimacy, making detection more challenging. Ethereum's programmable contracts are now being weaponized, marking a concerning evolution in blockchain-related cyber threats.

ETH Price Targets $5,500 as Whale Activity and Supply Trends Fuel September Optimism

Ethereum's price surged dramatically in August, nearing a record $4,900 after breaking through the $3,700-$4,000 resistance zone. The rally was driven by institutional ETF inflows, aggressive whale accumulation, and shrinking exchange reserves.

Binance data reveals a paradoxical trend—while reserves increased during August (typically signaling distribution), the broader market structure remains bullish due to illiquid supply conditions. Analysts now eye a September push toward $5,500, though caution persists about potential profit-taking pullbacks.

The ETH/USD pair currently tests reclaimed support at former resistance levels, with on-chain metrics suggesting sustained demand. Market participants are weighing short-term exchange inflows against the longer-term supply crunch created by staking and institutional custody solutions.

Ethereum Supply Crunch Sparks Altcoin Rally Potential

Ethereum's market dynamics are reaching a critical inflection point as institutional demand collides with shrinking supply. Exchange reserves have dwindled to 17.2M ETH - a dramatic decline from 25M five years ago - leaving just 5% of circulating supply readily tradable. This tightening coincides with $296M in recent ETF inflows across 12 consecutive days of accumulation.

The supply squeeze reflects broader institutional adoption, with public companies like BitMine Immersion amassing 300,000+ ETH positions. Ten corporate entities now collectively control over 1M ETH, excluding staking validators and asset managers. Such concentrated holding patterns mirror Bitcoin's early institutional adoption phase.

While Ethereum dominates attention, the supply crunch is redirecting capital toward high-growth altcoins. Emerging projects like Pepenode demonstrate how meme coin presales are capturing speculative interest. The market appears poised for a bifurcated rally: blue-chip ETH appreciation coupled with outsized gains in selective small-cap tokens.

SharpLink Expands Ethereum Holdings to Become One of World's Largest Holders

U.S.-based gaming giant SharpLink has significantly increased its Ethereum reserves, purchasing 39,008 ETH at an average price of $4,531 between August 25 and 31. This acquisition brings its total holdings to 837,230 ETH, valued at approximately $3.6 billion.

The company funded the latest purchases through an ATM offering, raising $46.6 million while issuing fewer shares compared to previous weeks. SharpLink's CEO emphasized a disciplined financial strategy focused on growing ETH reserves and generating staking rewards.

This move marks a clear pivot toward Ethereum since June, with the company positioning itself as a major institutional holder in the cryptocurrency space. The gaming firm also acquired 18,680 ETH through Galaxy Digital earlier in August.

Is ETH a good investment?

Based on current technical and fundamental analysis, ETH presents a compelling investment opportunity with some near-term caution advised. The current price of $4,323 represents a potential entry point below the 20-day average, offering value for long-term investors.

| Metric | Current Value | Implication |

|---|---|---|

| Current Price | $4,323 | Below 20-day MA, potential value |

| 20-day Moving Average | $4,438 | Resistance level to watch |

| Bollinger Support | $4,068 | Key downside protection |

| MACD Signal | -51.60 | Bearish momentum but improving |

Institutional accumulation and supply constraints create strong fundamental tailwinds, while technical indicators suggest careful position sizing given current bearish momentum. Michael from BTCC recommends 'dollar-cost averaging into positions with stops below $4,000 for risk management.'